Net Zero Directed Investing: what it means for us

Many companies and countries across the globe have committed to working towards a net-zero 2050 goal to tackle the climate crisis. This goal is critical for our planet, and, as investors, we have an important role to play in achieving it. That’s why abrdn has joined the Net Zero Asset Managers (NZAM) initiative.

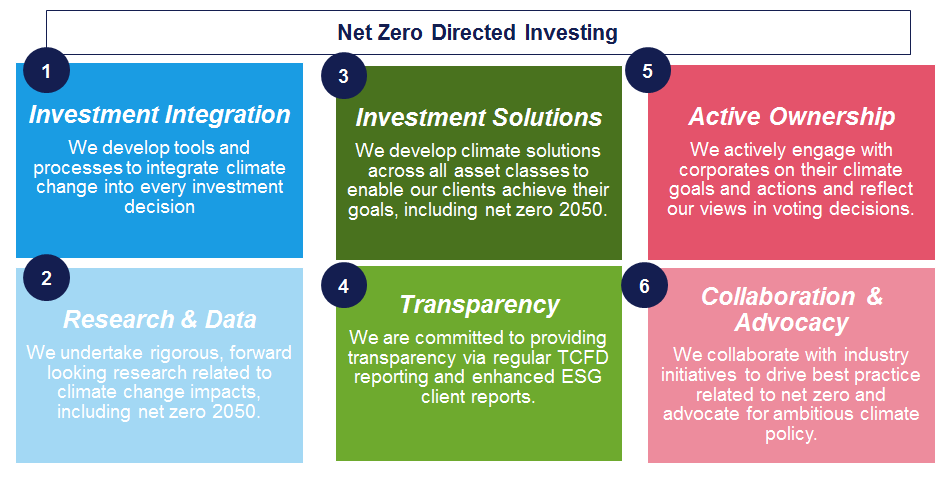

We’ve developed a climate change strategy focused on Net Zero Directed Investing (NZDI). That means moving towards the goal of net zero in the real world - not just in our portfolios. We seek to achieve this goal through a holistic set of actions, including rigorous research into net-zero trajectories, developing net-zero-directed investment solutions and active ownership to influence corporates and policy makers.

The direction of global net zero is clear as temperatures cannot be stabilised without emissions reaching net zero. However, when that might be reached is uncertain. Current pledges and policies fall woefully short of achieving the goals of the Paris Agreement to keep warming below 2C, ideally at 1.5C. Effective incentives in the form of appropriate carbon pricing are critical to enable capital allocation in line with net zero.

Our commitments

We are committed to working with our clients to help them achieve their climate goals, decarbonise and move towards Net Zero. By doing this, we expect to reduce the carbon intensity of our assets by 50% by 2030 vs a 2019 baseline1.

This will be delivered via three pillars of action:

- Decarbonisation: We are committed to tracking and reducing the carbon intensity of our portfolios. That means, continuing to incorporate carbon analysis into our investment process and supporting credible transition leaders and climate solutions. The majority of our public assets have a carbon intensity below benchmark (for example 70% of our Equity assets) and our Real Estate business has committed to aligning their assets to net zero 2050 pathways.

- Providing net zero solutions: We are committed to increasing the proportion of assets flowing into our net zero directed investing solutions. Around 30% of our AUM is currently expected to be managed in line with net zero 2050. We aim to increase this by continuing to develop net zero solutions across all asset classes, actively engaging with our clients as well shifting the abrdn fund range to support net zero goals - starting with a review of the carbon targets within our Article 8 & 9 funds.

- Active ownership: We are committed to voting and engaging with our investee companies to drive change and transitioning our real assets. We will engage with our highest financed emitters across equity and credit holdings seeking transparency on progress against clear transition milestones assessed against relevant standards such as the Climate Action 100+ net zero benchmark. We will divest from these companies where, after two years, we consider insufficient progress has been made against the transition milestones set, unless it is not in line with the mandate.

Sustainable change starts with our own operations. That’s why we have set an ambitious target to achieve a 50% reduction against our 2018 baseline in our operational emissions by 2025 - an important step towards our target of being net zero in our operations by 2040.

Our beliefs

Our climate change strategy is underpinned by four core beliefs:

- We believe the incorporation of climate risks and opportunities improves long-term returns for our clients and must be an integral part of the investment process.

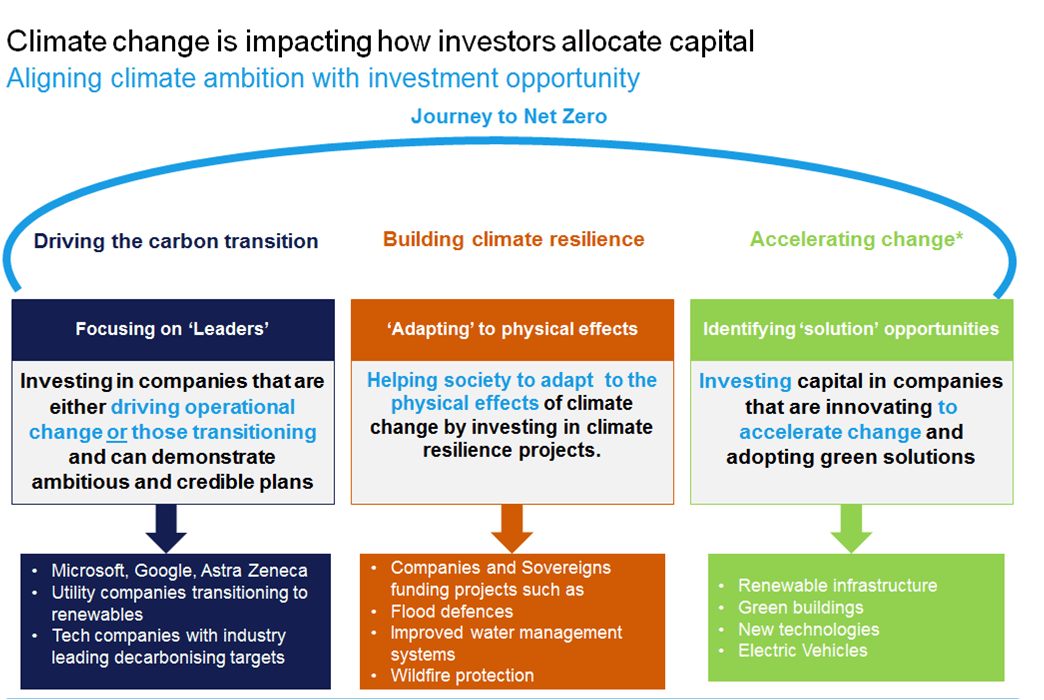

- We believe asset managers must take a forward-looking view to support the net-zero transition by providing capital to companies with ambitious and credible decarbonisation strategies and companies offering decarbonisation solutions.

- We believe active ownership is a powerful tool to influence real-world decarbonisation by challenging companies on their transition strategies and influencing corporate behaviour.

- We believe that stronger climate policy is fundamental to enabling capital allocation in line with net zero 2050 and we urge governments globally to step up ambition and action.

Implementing NZDI in practice

To put our NZDI strategy into practice, we focus on six areas:

“The aim of our climate-change strategy is to provide high-quality data and insights on climate-change trends, risks and opportunities that are fully integrated into our decision-making. We believe this will drive positive outcomes for our clients and support a real world transition to net zero.”

Eva Cairns, Head of Climate Change Strategy

1. Investment integration

Integrating climate change into our investment decisions is integral to our investment process. We’ve developed tools to identify material climate change risks and opportunities related to climate change. These tools include: carbon data analysis; forward-looking climate scenario analysis to understand the effects of different emissions, policy and technology pathways on asset values; green revenues to identify climate solutions; transition assessments to identify transition leaders and climate-change factors that we include in stock and sector research templates. We actively analyse how climate risks are being managed and reflect this in our decisions and corporate engagements. We systematically analyse carbon risk in our portfolios. As a result, most of our equity portfolios (over 70%), active quants portfolios (over 95%) and credit portfolios (over 50%) currently have a carbon intensity below their benchmark.

2. Research and data

The integration of climate change into our investment process is supported by rigorous climate-change research and data. This is embedded in our investment decision making and the design of our climate solutions. Recent research includes our climate scenario analysis white paper and climate policy index led by the abrdn Research Institute, our award-winning SAA (strategic asset allocation) climate paper and our Real Estate Net Zero Investment framework. You can read our climate-related research here. We complement our own research and data analysis with externally available data such as the Transition Pathway Initiative (TPI) scores. We are research funding partners of the TPI, and a case study on how we use TPI in our thinking is available here.

3. Net-zero-directed investment solutions

This is a major area of focus for us. We are proactively developing net-zero-directed investment solutions to align climate ambition with investment opportunity, to help our clients achieve their climate goals.

When developing net-zero solutions and targets, we use the Net Zero Investment Framework (NZIF)2 as a foundation for our approach. We have contributed towards this as part of our involvement in the Institutional Investors Group on Climate Change (IIGCC) Paris Aligned Investing initiative. The framework centres on real-world decarbonisation with a combination of targets that go beyond simple carbon metrics. The core features of the framework incorporate decarbonisation of assets within the portfolio by:

- Investing in transition leaders (rather than divestment)

- Allocation of capital to climate solutions increasing over time; and

- Targeted net-zero stewardship, focusing on the largest-financed emitters.

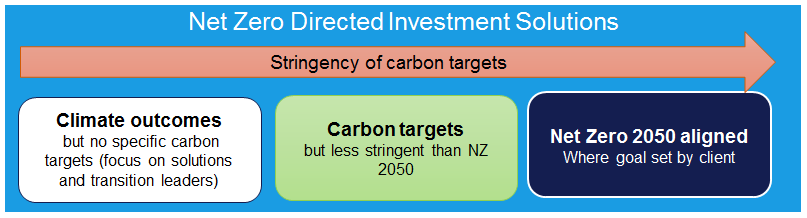

To meet the different climate goals of our clients, our net-zero-directed investment solutions span a range of options – from alignment with stringent net-zero-2050 decarbonisation trajectories to less stringent carbon targets or a dedicated focus on climate solutions. All these solutions support the ultimate goal of net zero.

For clients with net-zero-2050 goals, we are currently developing frameworks and solutions across asset classes to help meet those ambitions. For example:

- Our equities team has developed an Active Climate Transition (ACT) investment approach based on the NZIF and a forward-looking view on carbon emissions.

- Our fixed-income team is using a combination of analyst expertise, our in-house climate scenario analysis and external data to assess credible transition company alignment with net zero pathways and identify climate solutions.

- In our real estate investments, we have committed to working with all our clients to transition their portfolios to net zero by 2050 with clear net zero pathways for all funds by 2025. To help us achieve this, we’ve developed a net-zero framework for real estate.

- We incorporate net-zero considerations into our SAA, and embed climate change in risk-return optimisations. You can find more on the topic in our award-winning SAA research paper and the net-zero investment strategy paper published in collaboration with Phoenix, our largest client committed to net zero 2050.

4. Transparency

We are strong supporters of the TCFD (Task Force on Climate-Related Financial Disclosures) framework to provide transparent climate disclosure. We published our second TCFD report in June 2021. We will report on progress against our commitments on an annual basis via our TCFD and client reports, including decarbonisation progress and investment in climate solutions. Our in-depth ESG client reports provide greater transparency for our clients (worth £150 billion in assets) to better understand the climate-related effects of their portfolios.

5. Active ownership

We believe regular engagement with investee companies is essential in order to understand management of climate-related risks and opportunities, and to influence capital allocation into low-carbon activities. We have a set of core expectations related to climate change. For example, we expect companies to disclose in line with TCFD to provide transparency on how climate risks and opportunities are identified, managed and incorporated into business planning and target-setting. We provide examples of our regular engagement in our quarterly Active Ownership reports. For our actively held equity assets, we also reflect our views through our voting activities which are publicly available on our website. We actively vote against companies rated at the lowest levels for transition-management quality (TPI score of 0 or 1).

6. Collaboration and advocacy

Providing support and actively engaging with a range of climate-change associations and initiatives helps progress towards a net-zero economy. So, as an important part of our climate-change-related activities, we collaborate with industry associations on a number of initiatives to encourage action and promote best practice. We are members of the IIGCC, the Powering Past Coal Alliance (PPCA) and Climate Action 100+. In addition, we advocate for more ambitious and effective global policies to provide incentives and remove barriers for capital allocation in line with a net-zero pathway. For example, we are signatories to the 2021 Global Investor Statement on Climate Change to Governments. You can find out about our climate policy expectations ahead of COP26 in this article.

What’s next?

We will develop a clear baseline and approach for implementing our decarbonisation targets and publish more detail on our net zero directed investing strategy and solutions.

1 Assets initially in scope are Equities, Credit, active Quants, Real Estate and selected Multi-Asset strategies. More detail on our baseline and implementation approach will be published in a separate target setting paper. We are committed to this decarbonisation path on the expectation that climate policy will strengthen globally and we will review our commitments on a regular basis to reflect policy developments and client commitments.

2 IIGCC Net Zero Investment Framework, March 2021