Last February we wrote that “There’s growing appreciation among Chinese companies of the value that ESG policies can bring.” Almost two years later, the statement remains true.

We see similar commitment to environmental, social and governance (ESG). At the same time, we’re also witnessing a growing experience and recognition of the kind of dialogue and disclosure that international investors want to have. Data and disclosure remain something of a challenge, but has improved materially since February 2021. Many companies in China have actively sought feedback and input from investors, improved their disclosure, and released their inaugural sustainability reports. Of course, there’s more to go in this story, but progress is important and noteworthy.

China is perhaps the Asian market where we’re seeing the most progress and momentum on ESG, with companies increasingly proactive in their engagement with shareholders. Regulations and guidance are also improving, particularly relating to disclosure. For example, earlier this year we saw the release of the “Guidance for Enterprise ESG Disclosure”, effective June, and published by the China Enterprise Reform and Development Society. Importantly, the Guidance took input from a variety of stakeholders in China, including private and state-owned Chinese companies, financial institutions, universities and government entities. On the other side of the equation, China’s burgeoning ESG data industry is developing. We’re seeing a particular focus on collecting and providing proprietary China-focussed ESG data, as well as making use of innovative techniques, aimed at closing the information gap.

Fully engaged

One example of a company improving disclosure is Proya Cosmetics Co Ltd. The company is the fifth-largest domestic cosmetics brand in China, with a strong customer base targeting young people in lower-tier cities with good value products. We believe Proya is set to benefit from the ongoing 'premiumisation' trend, supported by R&D investment that has allowed it to launch higher-priced products.

As part of our due diligence and ongoing dialogue, we prioritised engagement with the company on its approach to the use of chemicals in cosmetics, animal testing, and sustainable packaging. The conversation was very positive, with the company willing to share information and provide perspective on the issues. We were encouraged by Proya’s response to our engagement; it was clear the company was more advanced in its thinking and practices than disclosure would suggest. We believed the company could disclose a lot more, and we encouraged management to do so. Our efforts have paid off. Proya has improved its disclosure, and MSCI upgraded the company’s ESG rating from CCC to BBB in October this year.

China’s ongoing focus on climate change

China’s focus on climate change is unchanged, with the country tweaking the language in its Nationally Determined Contribution (NDC) under the Paris Agreement, accelerating timeframes and ambition. China’s NDC document now provides for peak emissions before 2030 (as opposed to 'around 2030' previously), whilst policy is now aiming for non-fossil fuels’ share of primary energy consumption to reach 25% by 2030 (up from 'around 20%' previously – see here).

Again, there’s more that can be done, and even greater ambition is required. However, this is another indicator of the country’s commitment to addressing climate change. Moreover, whilst China is committed to addressing climate change at the state level, companies are also increasing their own climate ambitions. More importantly, a number of Chinese companies are well placed to contribute to global decarbonisation.

One area of focus for our investments is the leading role that Chinese companies play in green technology. China dominates global manufacturing capacity for renewable energy and storage technologies, with many firms global leaders in these fields. Decarbonising the global economy requires huge investments in renewable energy and storage, meaning China is potentially set to benefit.

Decarbonising the global economy requires huge investments in renewable energy and storage, meaning China is potentially set to benefit

Here, we’ve had some very encouraging engagements with both solar- and wind-focussed companies. On solar, we’ve had extensive and long-standing engagements with our portfolio holdings on supply chain management. During these meetings we ask about companies’ approaches to their own supply chains, the structures, processes and checks and balances they have in place, their approach to vigilance, and general experience thus far. On wind, we’ve been engaging on a variety of factors. Most recently, on the recyclability of wind turbine blades, an increasingly important topic in renewable energy given the growing complexity of blade engineering.

Building a greener future

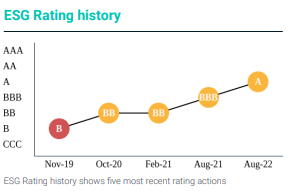

China also has an important role to play in decarbonising real estate and construction, given these sectors’ contribution to global carbon emissions. Our due diligence had identified China Resources Land as a local leader in developing green real estate, albeit a leader that was not getting the market recognition it deserves. We engaged extensively to both better understand its practises (in quite some detail), and to encourage greater disclosure. This was a long process, and one where we knew that our engagement would span several years. Encouragingly, our patient and constructive approach has helped the company improve disclosure. The market has recognised these efforts: MSCI recently upgraded China Resources Land’s ESG rating from BBB to A, continuing a series of upgrades that started in November 2019 (see chart).

There are other innovative companies that’re similarly using technology to decarbonise real estate and construction. For example, Glodon develops application software for the construction industry, which helps reduce inefficiencies, waste and overall environmental footprint. Our engagements and discussions with management have been positive. They’ve recognised that the construction sector in China contributes to pollution, and that technology can be used to help address this issue, whilst also reducing waste, and improving energy efficiency and production.

In good health

Moving from the E to the S, another focal point for us in China is healthcare. We invest in healthcare companies that provide innovative research and clinical trial services. Their goal is to help to ensure that high-quality therapies are brought to market more efficiently and cost-effectively. This ties in with Chinese policy objectives of making healthcare cheaper and more accessible to all. Given the demographic challenges that China faces, including a rapidly ageing society, there’s an added impetus for making healthcare more affordable and accessible to reduce the economic burden on the nation.

In the healthcare space, one area of focus for our engagement has been on approaches to animal testing. We’ve questioned companies on their policies and approaches, the governance process that oversees animal testing at an organisation, and the provision of training to healthcare professionals. We’ve been impressed with many companies’ responses. Several have shared a wealth of documents to evidence their position on animal testing. A number of our companies are also part of a broader global ecosystem, and so it should be expected that they will adhere to international standards. Nonetheless, we were very encouraged by the enthusiasm and depth with which companies engaged with us.

What does this mean for investors?

There’s a well-known Chinese saying that a journey of a thousand miles begins with a single step (千里之行,始于足下). China took its first steps in ESG some time ago, and is progressing well in its journey (better than many give it credit for). Of course, it would be naïve not to acknowledge that the journey is indeed a thousand miles, and that there are plenty of miles to go. With that in mind, investors have a meaningful role to play in patiently and constructively engaging with Chinese companies on ESG. They should aim to encourage businesses to change where necessary and improve disclosure so that their ESG credentials are more apparent.

Given data and information gaps, China remains an inefficient market when it comes to identifying ESG leaders – but we believe this inefficiency creates opportunity for active managers to identify both the current and next generation of ESG leaders in China.

You can find out more about our China capabilities here.

Companies are selected for illustrative purposes only to demonstrate the investment management style described herein and not as an investment recommendation or indication of future performance. Past performance is not a guide to future results.