Rarely have financial market conditions been so challenging. Advanced economies are hiking interest rates to contain high inflation, while recession fears are clouding prospects for the global economy. This has put equity and bond markets under pressure and left investors unsure which way to turn.

One new area that investors might want to diversify into is listed alternative assets.

What are listed alternatives?

Alternative asset classes used to be accessible only to the largest institutions. Now individuals can buy them via investment companies listed on exchange – similar to REITs but with a wide range of underlying assets, not just property. This has increased the ability of individuals to build genuinely diversified portfolios.

Listed alternatives comprise a range of asset classes and sub-sectors. Infrastructure can encompass renewable energy, energy storage, schools, hospitals, roads, data centres and mobile towers, while property can be as diverse as healthcare facilities, social housing and student accommodation (see example below).

Why listed alternatives?

Listed alternatives often have different revenue drivers to equities and bonds, meaning lower sensitivity to the global economic cycle.

- The ups and downs of economic growth have less bearing on their revenues, so they can be better-placed to deliver RESILIENT INCOME in more challenging economic environments. With different risk and return drivers, many listed alternatives have the potential to produce positive growth AND income in a variety of economic scenarios.

- The revenues of listed alternatives are often linked to inflation, either directly through government subsidies, such as for renewable and social infrastructure, or indirectly. Inflation can be positive for revenue growth. In contrast, traditional assets tend to provide limited INFLATION PROTECTION.

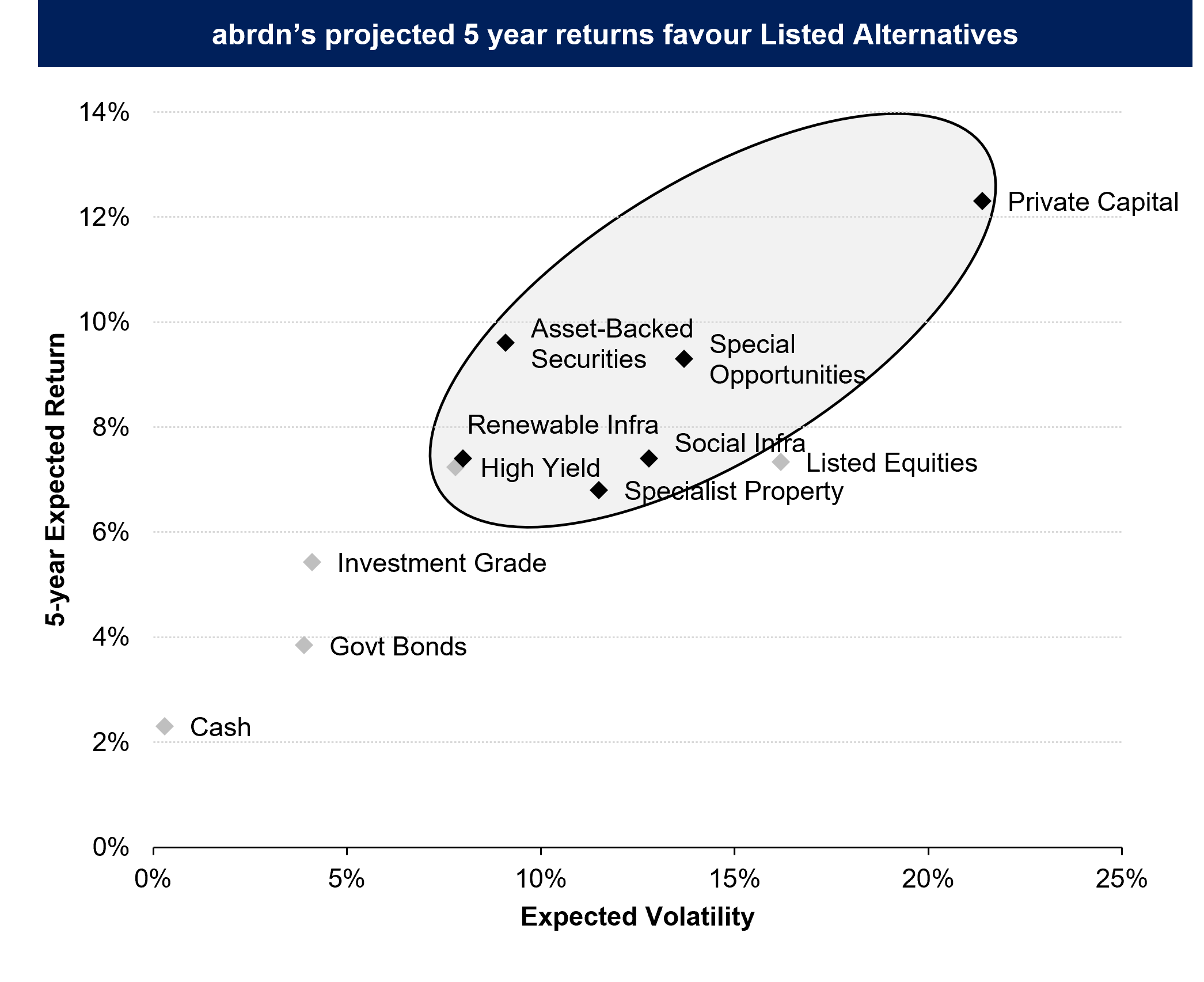

- Typically listed alternatives offer HIGHER RISK-ADJUSTED RETURN potential to equities and bonds (see chart 1). Generally they have been, and are expected to remain, less volatile and provide higher returns. Further, these assets are listed on exchange – so investors can buy and sell them on a daily basis. There is no capital lock-up.

In addition, many listed alternatives have LOW CORRELATION to traditional assets such as equities*, helping investors to diversify risk. It enables them to become less reliant on global equities to generate growth. In this way, diversification can help to reduce portfolio volatility and downside risk.

*Source: abrdn, Bloomberg.

Chart 1

Source: abrdn, Bloomberg. Based on expected asset class returns, 30 September, 2022. Forecasts are offered as opinion and are not reflective of potential performance. Forecasts are not guaranteed and actual events or results may differ materially.

Listed alternatives

Here we highlight five alternative asset classes available through listed investment companies:

-

Infrastructure

Physical assets such as roads and bridges (hard infrastructure); and services that support economic and social needs (soft infrastructure). Projects often benefit from subsidies and inflation-linked revenues (such as renewable energy), offering some shelter from economic cycles and volatility.

-

Listed private capital

Investing in underlying assets not traded on a public exchange, including in private companies (private equity); in private debt, where investors lend directly to borrowers; and in listed managers of those assets. Listed private capital offers exposure to a range of assets with strong return potential.

-

Specialist property

Selected areas of the property market including healthcare social housing, student accommodation and residential. These more specialist areas can provide resilience against downturns in the economic cycle.

-

Special opportunities

Includes royalties for healthcare, music and precious metals. Royalties are payments to the owners of assets. Some firms invest in debt backed by royalties’ income. This sub-sector includes litigation finance – firms earning income by financing commercial litigation cases.

-

Asset-backed securities

A portfolio of largely mezzanine and collateralised debt backed by income-generating assets, typically offering higher yields than traditional credit but with comparable risk. Investments that have a variable rate structure are less sensitive to changes in interest rates.

Looking to invest with abrdn?

If you would like to know more, please complete the form below and we will provide more information to you.

This website is strictly for informational purposes only and does not constitute an offer to sell, or solicitation of an offer to purchase any security, nor does it constitute investment advice, investment recommendation or an endorsement with respect to any investment products.

Bloomberg data are for illustrative purposes only. No assumptions regarding future performance should be made.